The Operational Impact of IEEPA, Section 301 and Additional Section 232 Duties on Steel & Aluminum Products

April 9, 2025IEEPA Reciprocal Tariffs ~ “Liberation Day Update”

April 9, 2025U.S. Importers are sure to feel the direct impact of additional tariffs regarding Bond Sufficiency and Stacking. As U.S. Importers bear the financial burden of increased tariffs on imported goods resulting in higher duties, the elevated Customs Duties could potentially adversely impact Bond Sufficiency as a result of greater Duty liability. Ultimately, the elevated Duties may result CBP requiring the U.S. Importer of Record to increase the overall amount of their Continuous Customs Bond (CTB) to match the increased financial exposure.

This article reviews the concept of Bond Sufficiency and Stacking – what these concepts are, how bond sufficiency is calculated, the determination of additional bond liability, and potential additional costs.

BOND SUFFICIENCY AND STACKING

IMPORTERS GUIDE TO RISK AVOIDANCE

CBP ISSUED A NOTICE OF INSUFFICIENCY FOR MY CUSTOMS BOND, WHAT ACTION DO I TAKE?

You likely have received a letter directly from U.S. Customs and Border Protection and / or your Customs Broker saying your bond is “insufficient to protect the revenue and ensure compliance with Customs and Border

Protection laws and regulations.”

WHAT DOES THIS MEAN? HOW IS BOND SUFFICIENCY CALCULATED?

CBP determines the minimum bond amounts for all importers, this is not done by your customs broker or your bond surety. The bond amount required is based on your total Duties, Taxes, and Fees (including any additional tariffs, i.e. China tariffs) or DTF. This calculation is based upon the previous “rolling” 12 months of imports, not calendar year, fiscal year, or bond term. CBP requires that your bond is sufficient to cover no less than 10% of

the total DTF for the previous 12-month period. These are calculated by CBP on a monthly basis.

HOW DO I DETERMINE WHAT BOND AMOUNT TO PURCHASE?

Forecast! To avoid future insufficiency notices, it’s imperative to forecast and calculate what your DTF will be for the next 12 months. Volumes, values, and duty rates in your import forecast may not be the same as the previous 12 months. Any expected increase or decrease in your import forecast should be accounted for. Some key metrics to keep in mind include, purchase price fluctuations, product line increases, potential tariff changes, and any other changes which could affect the future DTF.

IS THE AMOUNT RECOMMENDED ON THE CBP LETTER ACCURATE?

Before purchasing a new bond for the minimum bond amount listed on the CBP insufficiency notification, review your forecast and future import calculations with you LCHB or Surety Broker. This CBP minimum requirement is generally the next-tier bond amount offered and is not based on your company specific forecast. You may need a higher bond limit to avoid additional insufficiency notices and “Bond Stacking”. Just purchasing the next tier bond to save pennies could result in much higher costs in the future.

WHAT ADDITIONAL COSTS CAN RESULT FROM NOT PURCHASING THE RIGHT AMOUNT BOND?

When you “stack” bonds, the Surety’s liability and risk increases. Based on your companies’ financials, collateral may be required in addition to the purchase of the new bond. Depending on the Surety, collateral may be posted as cash or an irrevocable letter of credit. Either option effectively ties up cash resources and letters of credit usually involve significant additional costs assigned by the issuing bank.

WHAT IS BOND STACKING?

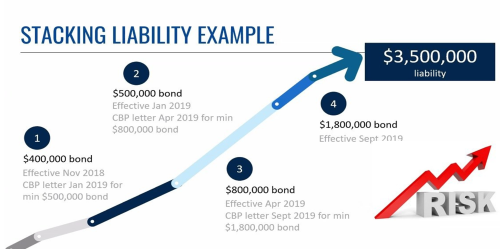

Bond Stacking occurs when multiple bonds for the same importer are effective at the same time. The Surety’s financial exposure to claims does not terminate until all entries secured by a bond have liquidated. Because entries do not liquidate for (at lease) 314 days, the Surety typically retains full penalty amount liability under both the previous (terminated) bond and the new (replacement) bond. As this aggregate exposure to the Surety increases, the underwriting process becomes more cumbersome and the Surety’s need for collateral becomes more accurate.

THE BOTTOM LINE ON SUFFICIENCY AND STACKING

When you receive an insufficiency letter, it is important to act promptly but don’t rely on CBP to properly determine the bond amount you may need. Seek out assistance from your Customs Broker to in determining the best way to stay compliant, minimize costs and avoid future insufficiency notifications.